Why have businesses in advanced economies not been investing more in machinery, equipment and plants? Business investment is the largest component of private investment, and its weakness has puzzled many of us.

Some believe that the key to more business investment is less uncertainty about fiscal policy, regulation, and structural reforms. Some believe that it is providing better financing, including for small and medium-sized enterprises (SMEs).

But analysis says these explanations are limited. The facts suggest a much simpler answer: Business investment has been weak because economic activity has been weak. Ensuring a recovery in sales and sales prospects is the key.

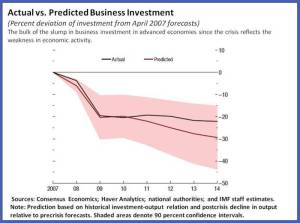

A study we published in the April 2015 World Economic Outlook suggests that virtually all of the weakness in business investment in advanced economies since the crisis can be explained by the weakness in the economic environment (see chart). This is in line with the "accelerator effect," where investment responds to changes in output and sales. (The study isolates the effect of weak growth on weak investment from other influences using a novel statistical approach.) Firms cut investment more severely following the crisis than in previous recessions, but the contraction in overall economic activity was also much more severe. All told the joint behavior of business investment and output has not been that unusual.

Now, as we leave the crisis behind, with faster growth in advanced economies, longer-term forces related to aging and lower productivity growth continue to cloud the horizon. According to our estimates, long-term growth in advanced economies is now about ½ percentage point lower than it was before the crisis. What’s more, weak banks and high levels of debt—public, corporate, or household—still weigh on spending and growth, to varying degrees. There is a risk that these longer-term forces come together and further reduce incentives to invest.

So, even as we see faster growth, policymakers need to remain focused on ensuring a sustained rise in private investment. Here, while policy advice must be country specific, some general principles apply.

With monetary policy in advanced economies having largely accomplished what it can, and borrowing costs still low, we need to look elsewhere for ways to boost growth. The case for more infrastructure investment remains. In countries where the conditions are right (e.g., Germany and the United States), such public investment can further spur demand in the short term, raise supply in the medium term, and, through the accelerator effect, give a boost to private investment today.

The message for policymakers is clear: Keep pushing the accelerator.